Tags: Economy WTO WTO Public Stockholding MSP Economic Growth Masala Bond Environmental Performance Index Forecast of Economic Growth Functions of the Finance Commission

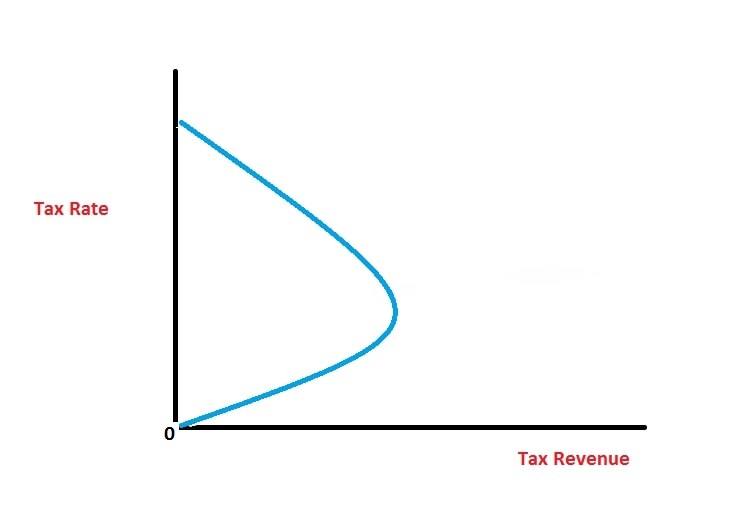

The Laffer Curve illustrates the relationship between tax rates and government revenue levels. It is a technical representation of the relationship between tax rates and revenue and is based on the premise that as the government raises tax rates, tax revenue rises. However, when tax rates are extremely high, tax evasion practices begin and people are less motivated to work, so lowering tax rates can increase revenue. It explains how the government can collect the most tax revenue possible by gradually lowering tax rates from high levels to optimal levels. The majority of direct taxes, like the personal income tax, can use the Laffer curve. In 1979, economist Arthur Laffer introduced it, and it was widely used in the 1980s. However, it was criticized for its simplistic assumptions, such as the idea that raising government revenue might not always be the best choice.

The Laffer Curve depends on the rule that bringing down charge rates support monetary development as it causes expanded spending by placing cash under the control of citizens. As a result, there is an increase in hiring and employment opportunities as a result of this increase in business activity to meet consumer demand. This replaces revenue lost as a result of tax cuts and affects the nation's overall economic activity. The Laffer curve is based on the observation that individuals alter their behavior in response to incentives provided by income tax rates.

The Laffer Curve predicts that, in theory, lowering taxes should increase tax revenues. It is predicated on the premise that the government will not receive any funding if tax rates are zero percent. Also, assuming duty rates were 100 percent, the public authority would get no income since there would be not a really obvious explanation in working. People may work longer hours and expand their businesses if tax rates rise and then fall. This increase in economic growth will lead to higher tax receipts, including higher income tax, corporate tax, and VAT. The concept is significant because it provides an economic justification for the popular political policy of lowering tax rates.

The Critique of the Laffer curve

1. The individual tax rate - Because of the complexity of the tax system, raising one tax rate can have a negative or positive impact on the benefits or benefits of lowering another. By assigning a single tax rate, the Laffer curve oversimplifies the relationship between taxes.

2. The T* or Ideal Assessment Rate Changes - Between 0 and 100, the ideal tax rate is determined by the Laffer Curve. However, economic conditions may alter this rate.

3. Rich people need tax cuts - In order to maximize government revenue, the Laffer curve requires tax cuts for the wealthy.

4. Presumptions of People and Organizations - The Laffer Curve expects that higher duties bring about lower incomes since organizations might leave and representatives will work less hours. However, employees may put in longer or harder hours in order to advance in their careers. Businesses don't just make decisions based on the tax rate; they also look for infrastructure and a skilled workforce, both of which can offset an increased tax rate.