Tags: Economy WTO WTO Public Stockholding MSP Economic Growth Masala Bond Environmental Performance Index Forecast of Economic Growth Functions of the Finance Commission

How are the GST and value-added tax calculated?

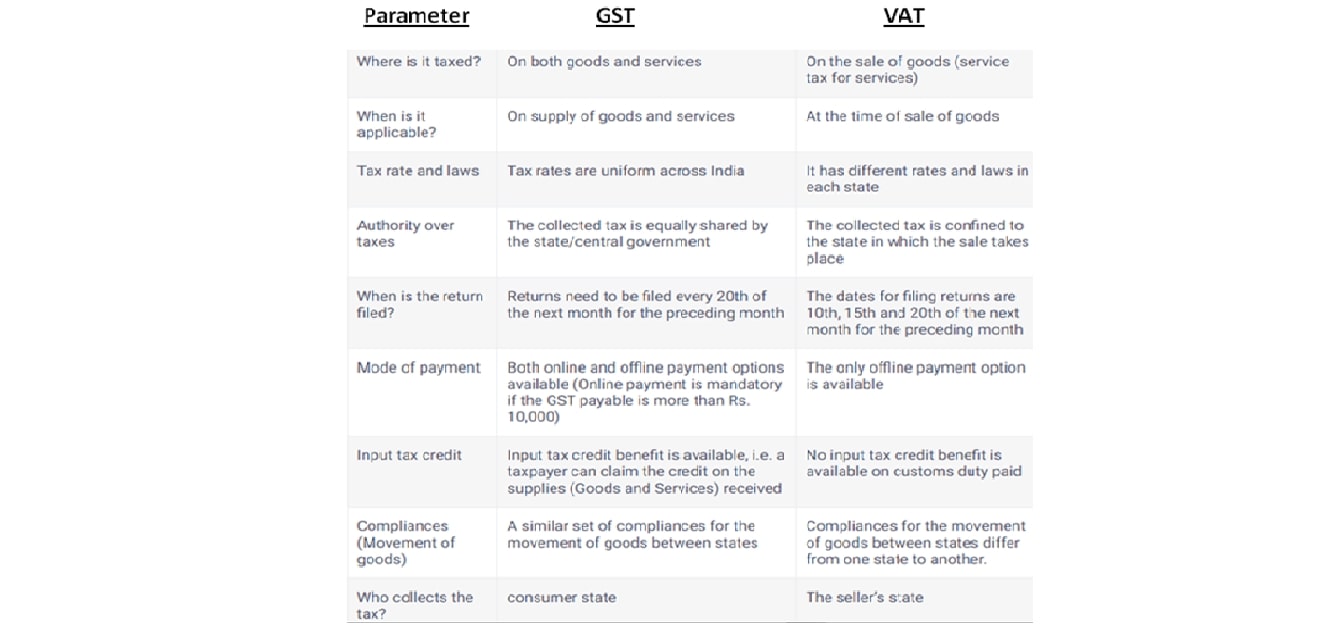

Even though prominent economists claim that VAT and GST are simply two names for the same tax, a close examination reveals the contrast. The difference between GST and VAT calculation can be clearly seen in the following example.

1. Under the VAT regime - Assuming the consultant charged a 15% professional tax on Rs. worth of services rendered under the VAT system, 1,00,000. As a result, its output taxable liability will be Rs. 1,00,000 x 12% = Rs. 15,000 . At that point, if the office supplies were purchased at a price of Rs. 30,000, Rs. will be due in the form of 5% Value Added Tax. 1500 (Rs. 30,000 x 5%). In this instance, the entire sum, Rs. 16,500 (Rs. 15,000 + Rs. 1500), as the output tax liability on services rendered cannot be deducted from the tax paid on supplies under the VAT system.

1. Under the GST regime - Let's say the consultant charged Rs. 18% in professional tax for services. 1,00,000. As a result, its output taxable liability will be Rs. 1,00,000 x 18% = Rs. 18,000. If the office supplies were purchased at a price of Rs. Rs. 30,000, with a 5% GST payment of Rs. 1500 (30,000 x 5%). The amount due in this instance will be Rs. 16,500 (Rs. 18,000 “ Rs. 1500) because, in contrast to VAT, GST permits the deduction of the supply tax from the output tax obligation on services rendered.

In essence, it should be noted that the implementation of GST on goods and services has proven to be more efficient in many ways due to the primary distinction between GST and VAT. However, there are still some goods that are not subject to GST at this time, such as gasoline, diesel, and alcohol. We can anticipate that additional goods and services will be included in the GST regime as it develops further.